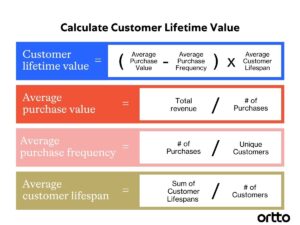

Customer Lifetime Value (CLV) in SaaS is calculated by multiplying average revenue per user (ARPU) by customer lifespan. It helps measure long-term profitability.

Understanding CLV is crucial for SaaS businesses. It provides insights into customer retention and revenue potential. By knowing CLV, companies can allocate resources more effectively. They can improve customer retention strategies and optimize marketing efforts. Calculating CLV involves identifying ARPU and average customer lifespan.

ARPU is the monthly revenue per customer. Customer lifespan is the average duration a customer stays with the company. Accurate CLV calculation helps in making informed business decisions. It also enhances financial forecasting and strategic planning. By focusing on CLV, SaaS businesses can achieve sustainable growth and profitability.

Introduction To Saas Clv

Customer Lifetime Value (CLV) is crucial for SaaS businesses. It helps companies understand the total revenue from a customer over their relationship. By calculating CLV, you can make better marketing and sales decisions. This metric helps in predicting future revenue and guiding long-term strategies.

The Importance Of Clv In Saas

CLV is a key metric for SaaS companies. It helps in assessing the value of each customer. Knowing the CLV can guide your customer acquisition strategies. It also helps in determining how much to spend on customer retention.

- Better Marketing Decisions: CLV helps in allocating marketing budgets effectively.

- Customer Segmentation: Segment customers based on their lifetime value.

- Predict Future Revenue: CLV helps in forecasting future earnings.

How Clv Affects Profitability

CLV directly impacts a company's profitability. Higher CLV means more revenue from each customer. This reduces the need for constant customer acquisition. It also increases the return on investment (ROI) for marketing efforts.

Here is a simple table to understand how CLV affects profitability:

| Customer Acquisition Cost (CAC) | Customer Lifetime Value (CLV) | Profitability |

|---|---|---|

| $100 | $500 | High |

| $100 | $200 | Medium |

| $100 | $100 | Low |

Focusing on increasing CLV can lead to sustainable growth. It also makes your business more resilient to market changes.

Credit: www.wallstreetprep.com

Key Components Of Customer Lifetime Value (CLV)

Understanding the Key Components of CLV is crucial for SaaS businesses. By breaking down these components, you can gain insights into your customers' value over time. These insights can help you make informed decisions and optimize your strategies. Let's dive into the key components: Average Revenue Per User (ARPU), Customer Churn Rate, and Customer Retention Costs.

Average Revenue Per User (ARPU)

ARPU measures the average revenue generated per user over a specific period. It's a critical metric for understanding revenue trends. To calculate ARPU, divide the total revenue by the number of users.

ARPU = Total Revenue / Number of UsersFor example, if your total revenue is $10,000 and you have 100 users, your ARPU is $100. This metric helps identify how much revenue each customer brings in. Regularly monitoring ARPU can help you spot growth opportunities.

Customer Churn Rate

Customer Churn Rate measures the percentage of customers who leave your service. Keeping track of churn rate is essential for maintaining a stable customer base. To calculate churn rate, use the following formula:

Churn Rate = (Number of Customers Lost / Total Customers at Start) 100For example, if you started with 200 customers and lost 10, your churn rate is 5%. A high churn rate indicates customer dissatisfaction. Reducing churn rate can significantly improve your CLV.

Customer Retention Costs

Customer Retention Costs refer to the expenses incurred to keep a customer engaged. These costs include marketing, customer support, and loyalty programs. Calculating retention costs helps you understand the investment needed to retain customers. Here's a simple table to illustrate:

| Cost Type | Amount |

|---|---|

| Marketing | $500 |

| Customer Support | $300 |

| Loyalty Programs | $200 |

Total Retention Costs = $500 + $300 + $200 = $1,000

By understanding and optimizing retention costs, you can improve profitability. Investing in retention strategies can help boost your CLV.

Calculating Clv: Step-by-step

Understanding Customer Lifetime Value (CLV) is crucial for any SaaS business. This metric helps you gauge the total revenue a customer brings during their relationship with your company. Let’s break down the process of calculating CLV into simple, actionable steps.

Identifying Revenue Streams

First, determine your revenue streams. These include subscription fees, add-on services, and any one-time charges. Create a list of all potential revenue sources. This will form the base for your CLV calculation.

| Revenue Stream | Example |

|---|---|

| Subscription Fees | $20/month |

| Add-On Services | $10/month |

| One-Time Charges | $50/setup fee |

Estimating Customer Lifespan

Next, estimate the customer lifespan. This is the average duration a customer stays with your service. Use historical data for accuracy. For example, if customers stay for 24 months on average, your customer lifespan is 2 years.

Calculate the average lifespan using this formula:

Customer Lifespan = 1 / Customer Churn Rate

Incorporating Costs And Churn

To get a complete picture, include costs and churn rates. Calculate the cost of acquiring and maintaining a customer. These costs include marketing expenses, customer support, and service delivery.

Use this formula to calculate CLV:

CLV = (Average Revenue per Customer per Month x Customer Lifespan) - Customer Acquisition Cost

For example, if your average revenue per customer is $30/month, and your customer lifespan is 24 months, and your acquisition cost is $100:

CLV = ($30 x 24) - $100 = $620

By following these steps, you can accurately calculate the CLV for your SaaS business.

The Role Of Customer Acquisition Cost

Understanding the Role of Customer Acquisition Cost (CAC) in SaaS businesses is crucial. It affects your Customer Lifetime Value (CLV) directly. CAC is the cost to acquire a customer, while CLV measures the total revenue from a customer over their lifetime. Balancing these metrics is key to your SaaS company's success.

Cac And Its Impact On Clv

CAC can significantly affect your CLV. If CAC is high, it takes longer to recover the investment. High CAC can reduce your profit margins. Understanding this helps in making informed decisions.

Let's break it down with a table:

| Metric | Definition | Impact on CLV |

|---|---|---|

| CAC | Cost to acquire one customer | Higher CAC lowers initial profits |

| CLV | Total revenue from a customer | Higher CLV increases overall profitability |

Balancing Cac With Clv

Balancing CAC with CLV is essential. Here are some tips:

- Focus on reducing CAC through efficient marketing.

- Increase customer retention to boost CLV.

- Analyze customer behavior to optimize spending.

Here’s a quick list to keep in mind:

- Calculate your current CAC and CLV.

- Identify areas to cut costs.

- Improve customer retention strategies.

Effective balancing helps your SaaS business grow sustainably. By focusing on both metrics, you can achieve long-term success.

Maximizing Clv With Customer Retention Strategies

Maximizing Customer Lifetime Value (CLV) with effective retention strategies is essential. Retaining customers ensures steady revenue and boosts profitability. Let's explore key tactics to enhance CLV through customer retention.

Engagement Tactics

Engaging customers keeps them interested in your product. Active communication is crucial.

- Email Campaigns: Send personalized emails regularly.

- Social Media Interaction: Respond to comments and messages promptly.

- Webinars and Workshops: Offer value through educational content.

These tactics help build strong relationships. Consistent engagement fosters loyalty.

Personalization And Customer Success

Personalization tailors experiences to individual needs. It shows customers you care.

| Strategy | Details |

|---|---|

| Personalized Recommendations | Suggest products based on past purchases. |

| Customized Offers | Provide special discounts for loyal customers. |

Customer success ensures users achieve their goals. Offer dedicated support teams.

- Onboarding Assistance

- Regular Check-Ins

- Proactive Problem Solving

This approach helps customers maximize value from your product. Happy customers stay longer, increasing CLV.

Credit: www.saasceo.com

Utilizing Data Analytics For Clv Optimization

Utilizing data analytics for CLV optimization can revolutionize how businesses understand and manage their customers. By leveraging advanced analytics, companies can predict future customer behavior, enhance customer experiences, and ultimately increase their Customer Lifetime Value (CLV).

Predictive Analytics In Clv

Predictive analytics uses historical data to forecast future customer actions. Businesses can identify which customers are most likely to churn. They can also determine which are most likely to make repeat purchases.

Using machine learning models, companies can analyze customer patterns. This helps in segmenting customers based on their behavior. Such segmentation helps in crafting personalized marketing strategies. Personalized strategies lead to higher customer retention and increased CLV.

Here’s a simple table to show the benefits of predictive analytics in CLV:

| Benefit | Description |

|---|---|

| Customer Segmentation | Group customers based on behavior for targeted campaigns. |

| Churn Prediction | Identify customers at risk of leaving the service. |

| Upsell Opportunities | Spot customers likely to purchase additional products. |

Leveraging Customer Feedback

Customer feedback is a goldmine of information. It provides insights into customer preferences and pain points.

Analyzing feedback helps in understanding what customers love and what they dislike. This data can be used to improve products and services.

Here are some ways to leverage customer feedback:

- Surveys: Conduct regular surveys to gather customer opinions.

- Reviews: Monitor online reviews to identify common themes.

- Social Media: Track social media mentions and comments.

Using this feedback, companies can make informed decisions. Improving customer satisfaction leads to higher retention rates and increased CLV.

Clv-driven Pricing Strategies

Understanding Customer Lifetime Value (CLV) is crucial in SaaS. It helps in creating effective pricing strategies. These strategies aim to boost revenue and retain customers. By focusing on CLV, businesses can tailor their offerings and maximize profits.

Tiered Pricing Models

Tiered pricing models offer multiple subscription levels. Each level provides different features and benefits. This strategy targets diverse customer needs and budgets. Here's a simple table to showcase an example:

| Tier | Features | Monthly Price |

|---|---|---|

| Basic | Limited features | $10 |

| Standard | Standard features | $20 |

| Premium | All features | $30 |

Basic Tier attracts new users. Standard Tier suits regular users. Premium Tier is for advanced users seeking more features. This approach improves CLV by catering to different user needs.

Subscription Renewal Incentives

Offering subscription renewal incentives encourages users to stay longer. These incentives can be discounts, additional features, or exclusive content. Below are some common incentives:

- Discounts on annual renewals

- Bonus features for renewing early

- Exclusive content for loyal customers

Discounts make long-term plans more appealing. Bonus features add value to the subscription. Exclusive content rewards loyalty and enhances user experience. These tactics keep customers engaged and increase CLV.

Credit: userpilot.com

Case Studies: Successful Clv Enhancement

Understanding Customer Lifetime Value (CLV) is crucial for SaaS businesses. Real-life examples show how companies can enhance their CLV. Below, we explore strategies from tech giants and innovative startups.

Tech Giants' Clv Strategies

Tech giants like Apple and Microsoft excel in CLV enhancement. They focus on customer satisfaction and retention.

- Apple's ecosystem keeps customers engaged with multiple products.

- Microsoft uses subscription models like Office 365 to ensure recurring revenue.

Both companies utilize data analytics to understand customer behavior. They then tailor their services to meet customer needs.

Startups Transforming Clv

Startups like Slack and Zoom have revolutionized CLV strategies. They focus on user experience and seamless integration.

- Slack offers a freemium model to attract and retain users.

- Zoom provides easy-to-use features and reliable performance.

These startups leverage customer feedback to continuously improve their offerings. Their agile approaches make them adaptable and customer-centric.

| Company | Strategy | Outcome |

|---|---|---|

| Apple | Product Ecosystem | Increased Customer Loyalty |

| Microsoft | Subscription Models | Steady Revenue Stream |

| Slack | Freemium Model | High User Retention |

| Zoom | User-Friendly Features | Rapid Growth |

These case studies highlight the importance of customer-centric strategies. Companies that focus on customer needs see significant CLV enhancement.

Future Trends In Clv For Saas Businesses

The SaaS industry continues to evolve rapidly. Understanding Customer Lifetime Value (CLV) is more important than ever. Future trends in CLV calculation will shape how businesses operate and grow. This section explores two major trends: AI and Machine Learning, and The Growing Importance of Customer Experience.

Ai And Machine Learning

AI and Machine Learning are transforming CLV calculations. They offer deeper insights into customer behaviors.

Machine Learning algorithms analyze vast amounts of data quickly. They identify patterns and predict future customer actions.

This technology helps businesses customize their marketing strategies. It also optimizes customer engagement and retention.

Here are some ways AI impacts CLV:

- Predictive Analytics: AI forecasts customer churn and helps reduce it.

- Personalized Recommendations: Machine Learning offers tailored product suggestions.

- Automated Customer Support: AI bots provide quick and efficient customer service.

Investing in AI and Machine Learning can enhance customer value. These technologies enable precise targeting and improve customer satisfaction.

The Growing Importance Of Customer Experience

Customer Experience (CX) plays a crucial role in CLV. Satisfied customers stay longer and spend more.

Focusing on CX involves understanding customer needs and preferences. This leads to better service and product offerings.

Here are some factors that improve CX:

- User-Friendly Interfaces: Easy-to-navigate platforms enhance user satisfaction.

- Personalized Interactions: Custom messages and offers make customers feel valued.

- Consistent Communication: Regular updates and feedback loops keep customers informed.

Improving CX can significantly boost CLV. Happy customers are loyal and provide valuable referrals.

Businesses should prioritize customer feedback and continually improve their services. This approach leads to long-term success and higher customer lifetime value.

Conclusion: The Continuous Journey Of Clv Improvement

Calculating Customer Lifetime Value (CLV) is not a one-time task. It's a continuous journey that evolves with your business. Regularly updating and refining your CLV calculation helps businesses stay competitive. This journey includes iterative strategies and fostering a customer-centric culture.

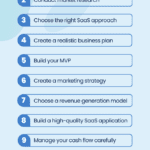

Iterative Clv Strategies

Implementing iterative CLV strategies is crucial. Regular analysis and adjustments ensure accuracy. Here are some effective strategies:

- Regular Data Review: Continuously review customer data for up-to-date insights.

- Segment Customers: Group customers based on behavior and value.

- Personalized Marketing: Use personalized marketing to increase customer retention.

- Feedback Loops: Implement feedback loops to understand customer needs.

Each strategy should be evaluated and refined. This helps in maintaining an accurate CLV calculation.

Building A Customer-centric Culture

Building a customer-centric culture is essential for CLV improvement. A business focused on customers sees higher retention rates. Consider the following steps:

- Employee Training: Train employees to prioritize customer needs.

- Customer Feedback: Regularly seek and act on customer feedback.

- Customer Service: Provide exceptional customer service experiences.

- Community Engagement: Engage with customers through community-building activities.

A customer-centric culture not only enhances CLV but also builds long-term loyalty. Focusing on customers drives continuous improvement in CLV.

Frequently Asked Questions

What Is Customer Lifetime Value (clv)?

Customer Lifetime Value (CLV) measures the total revenue a customer generates throughout their relationship with your business. It helps in understanding customer profitability.

How Do You Calculate Clv For Saas?

To calculate CLV for SaaS, multiply the average revenue per user (ARPU) by customer lifespan. Adjust for gross margin and churn rate if needed.

Why Is Clv Important For Saas Businesses?

CLV is crucial as it helps in understanding long-term customer profitability. It guides marketing and sales strategies to focus on valuable customers.

What Factors Influence Saas Clv?

Key factors include average revenue per user (ARPU), customer retention rate, and customer acquisition costs. Improving these can enhance CLV.

Conclusion

Understanding SaaS Customer Lifetime Value is crucial for long-term success. It helps optimize marketing and customer retention strategies. Focus on accurate data collection and analysis. Implementing these insights can boost profitability and growth. Start calculating your CLTV today to enhance your business outcomes.